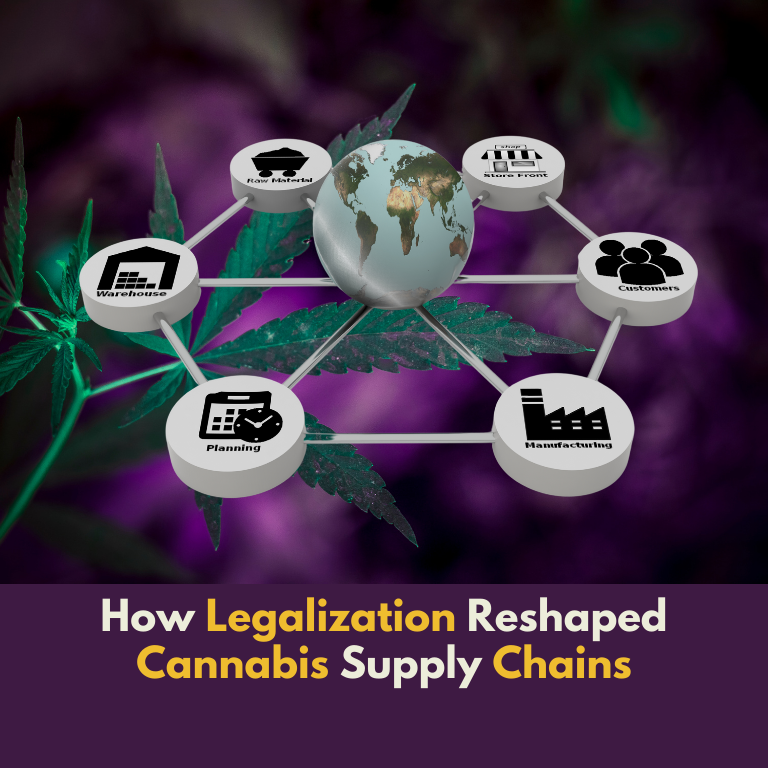

With the rapid expansion of cannabis legalization across various states in the US, cannabis delivery services have emerged as one of the most rapidly growing segments within the industry. This surge in demand for delivery options presents numerous opportunities for entrepreneurs seeking to enter the cannabis market.

As the cannabis industry continues to evolve and expand, the rise of cannabis delivery services has become a prominent trend. With the increasing legalization of cannabis across various states in the US, delivery services have emerged as a crucial component of the industry’s infrastructure. However, along with the opportunities presented by this burgeoning market come unique challenges, particularly in terms of risk management and insurance coverage.

The Growing Demand for Cannabis Delivery Services

With cannabis legalization gaining momentum, consumers are increasingly seeking convenient and discreet ways to access cannabis products. This shift in consumer behavior has fueled the rapid growth of cannabis delivery services. From medical marijuana patients seeking relief to recreational users looking for convenience, the demand for cannabis delivery is on the rise.

Understanding the Risks

While the growth potential of the cannabis delivery market is undeniable, it also comes with inherent risks. Delivering cannabis products involves navigating a complex regulatory landscape, ensuring compliance with state and local laws, and addressing safety concerns associated with transporting controlled substances. Additionally, delivery vehicles and inventory are susceptible to theft, accidents, and other unforeseen events, highlighting the need for comprehensive insurance coverage.

Insurance Solutions for Cannabis Delivery Services

To effectively mitigate risks and protect their businesses, cannabis delivery services require specialized insurance solutions tailored to their unique needs. Here are some essential types of insurance coverage for cannabis delivery services:

General Liability Insurance

- Provides coverage for third-party bodily injury, property damage, and advertising injury claims.

- Protects against lawsuits alleging negligence, such as slip-and-fall accidents at delivery locations.

Commercial Auto Insurance

- Covers vehicles used for cannabis delivery against accidents, theft, and vandalism.

- Provides liability coverage for bodily injury and property damage caused by delivery vehicles.

Product Liability Insurance

- Protects against claims related to the consumption of cannabis products, such as allergic reactions or adverse effects.

- Covers legal expenses and settlements in the event of product-related lawsuits.

Cargo Insurance

- Insures cannabis products in transit against theft, damage, or loss.

- Provides coverage for the value of the cargo being transported, including medical marijuana, edibles, and concentrates.

Cyber Liability Insurance

- Safeguards against data breaches, hacking attempts, and other cyber threats.

- Covers costs associated with notifying affected individuals, investigating the breach, and restoring compromised data.

Navigating the Insurance Landscape

Given the unique risks and regulatory challenges faced by cannabis delivery services, it’s essential to work with an insurance provider experienced in the cannabis industry. A knowledgeable insurance broker can help identify potential risks, assess coverage needs, and customize insurance policies to protect against specific liabilities.

Conclusion

As cannabis delivery services continue to proliferate, ensuring adequate insurance coverage is paramount for protecting businesses and minimizing financial risks. By understanding the unique risks associated with cannabis delivery and investing in comprehensive insurance solutions, delivery services can navigate the evolving regulatory landscape with confidence and deliver protection to their customers and stakeholders alike.